Looking to refinance your home loan?

Try our 'GPS' method for a fairer result

First things first, is refinancing the best option for you? Are you aware that you can negotiate your rate with your current bank?

We strongly believe that most mortgage brokers do comply with their best interests duty as outlined in Regulatory Guide 273 (external link) and always act in your best interest.

However, a conflict of interest does exist to some extent – sometimes, instead of refinancing to a new bank, it might be more beneficial (or makes more sense) for you to stay with your current bank – if they could simply lower your rate. On the contrary, your broker would not be paid upfront commission if you did not refinance.

Therefore, we introduced our ‘GPS’ approach in 2021 to minimise the above conflict of interest, which has achieved great results in both our customer satisfaction and work efficiency.

Industry-leading "GPS" approach

1. General Information Only

If your objective is to obtain a lower rate only, we would only collect essential information, such as loan type, approximate loan amount and loan to value ratio (LVR). Thereafter, we will provide you with a competitor’s rate⇓, so that you can contact your current bank and negotiate with them.

2. Personal Circumstances

If your current bank could not lower your rate, or you were not satisfied with their counter-offer, and decided to refinance to a new bank, one of our brokers would contact you to arrange a remote or face-to-face home loan interview, so that we can have an in-depth understanding of your personal circumstances.

3. Solution

After we have verified your financial situation, we will be able to provide you with a solution tailored to your financial position, requirements and objectives. If you were satisfied with our solution, we would submit your refinance application for you.

About 23 Finance

We are a Sydney based mortgage broking firm with a large clientele in Sydney, Newcastle and Wollongong.

Our experienced broker team always put our customers first – we will continue to uphold our FIVE commitments to ensuring our customers enjoy a personalised, seamless and hassle-free home loan experience.

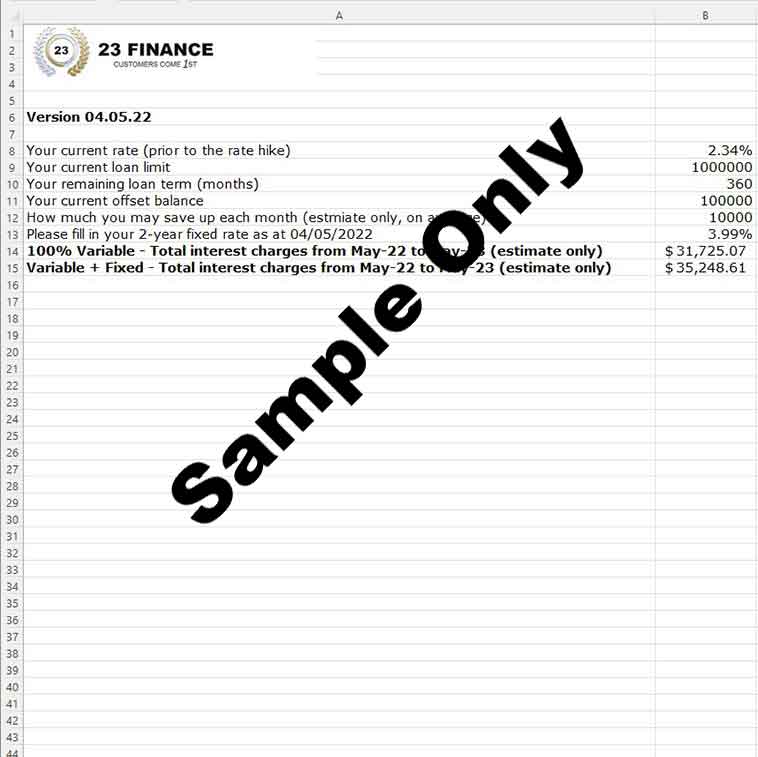

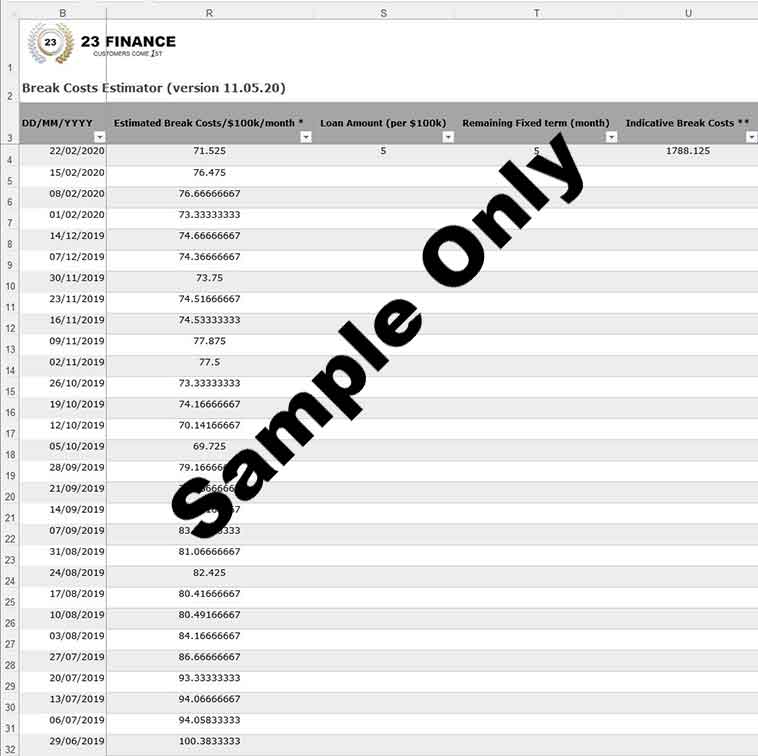

Furthermore, our customers will gain unlimited access (upon their loan approval) to the resources and tools prepared by our support team to assist them in making a more informed decision.

Company Vision

We are looking to grow our business sustainably – we would not like to devolve our customer service to standard operating procedures and scripted answers delivered by bots.

We would like to ensure that our customers can always talk to a real person – a person who cares about them.

30+ lenders on our panel

Why Choose Us?

Our FIVE commitments to you:

Would like to have an update on your application, but can never get hold of your broker? We are different! We have multiple channels for you to reach out to us, and we commit to respond you within one hour during business hours.

For any urgent after hours matter, please feel free to contact our principal broker Alex WANG on 0406 635 933

Would like to meet us in person, but too busy at work? Only available during your 1-hour lunch break? No worries! We have flexible appointment options available for you – you can choose a time and place that suits you best*, we will come to see you.

* Sydney Metroplitan area only; after hours appointment available; pre-booking required.

We are more than happy to answer your queries in writing**, to avoid any ‘he said, she said’ situation arise in the future (we don’t like it, too)

** upon your request

Have not heard anything from your broker since the settlement? We treat you differently. We touch base with you on a quarterly basis, and we review your loan(s) annually to ensure that your rate stays competitive.

We offer value-added complimentary member services to our customers. We will set up your full membership and email you your personal login once your loan is approved (incl. pre-approval). In addition, TWO additional 3-month trial membership can be set up upon your request for you to share with your family and friends. Our member services include but not limited to:

1. special offers from our external business partners (quote your membership number; at the sole discretion of our external business partners)

2. unlimited free customised property reports***

3. unlimited access to the resources and tools prepared by our support team

*** full membership required

Ready to Refinance?

Speak with one of our experienced home loan specialists today!

We treat every loan as a time critical project. Therefore, we have adapted project management processes to ensure that our customers enjoy a personalised, seamless and hassle-free home loan experience.

- 1. We make inquiries about your financial situation, requirements and objectives, etc.

- 2. After we have verified your financial situation, we will work out a plan with you.

- 3. We will submit your application for you with your consent.

- 4. We will continuously follow up with the lender and keep you posted.

- 5. Our relationship does not end at your loan settlement - We touch base with you on a quarterly basis, and we review your loan annually.